The speculation and vacancy tax is working – it has returned over 20,000 empty condos in Metro Vancouver alone. We're taking action to turn more empty units into homes for people by expanding the tax to 13 new BC municipalities. Learn more: Strongerbc.gov.bc.ca/Housing

B.C. Taxes: Explained

Your handy guide to B.C taxes in 2025

Have you ever felt lost when talking about taxes? From family dinners to casual conversations, tax talk is a topic anyone can rely on to complain about.

Here is a helpful, quick guide to some B.C. taxes you may need to brush up on or be acquainted with.

Provincial Sales Tax (PST)

B.C. provincial sales tax, also known as PST, is a sales tax that is applied to retail goods. Taxable goods include software, accommodation, new or used goods within B.C., internet services, movies, music, etc. As of January 2025, the PST rate is 7% of the purchased item or good. Not all businesses need to collect PST.

Excludes of PST include children-sized clothing, groceries, magazines, books and newspapers, prescription medicine and bicycles (who knew!).

Speculation and Vacancy Tax

To combat the housing crisis within the province, the speculation and vacancy tax was introduced in 2018 to ensure international buyers are contributing to B.C.'s economy.

The tax was implemented to help reduce the lack of vacant housing. The categories for paying the tax include an owner's residency status, property owners must report their income, and the property must be used regularly. An individual must declare their residency status on March 31st every year.

Starting today, the manufacture and import for sale of harmful single-use plastics in Canada is prohibited. This will result in the estimated elimination of over 1.3 million tonnes of plastic waste – leading to less pollution and healthier communities.

Single-Use Plastic Tax

To help address the climate crisis, B.C. has turned the tide against single-use plastics. Rather than providing plastic containers and stylophones, businesses will be quoted to pay for single-use shopping bags. The rollout began in December 2023 after the provincial government declared an estimation of "340,000 tonnes of plastic items and packaging were disposed of in 2019".

The province has asked businesses to charge a fee of $2 for every new reusable bag and a price of 25 cents for all recycled paper bags. The next part of the regulation will be rolling into 2028 with restrictions on cling wrap.

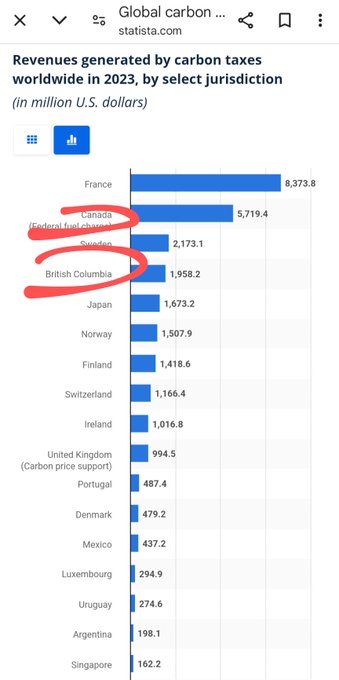

A Tax so nice we count it twice! #Canada takes 2nd place for #carbontax revenue globally, BC who doesn't have federal carbon tax ranks 4th on the globe for highest tax revenue. When the rates go up April 1 we'll be propelled into 1st place!

Carbon Tax

Not known to many, B.C. has implemented a carbon tax since 2008, but it became more prominent in 2018 with Justin Trudeau's parliament. In 2024, the B.C. carbon tax rose from $65 to $80 per CO2e tonne. For gasoline, 17.51 cents is applied per litre to meet the $80 rise, which is why so many conversations are complaining about gas prices.

The carbon tax has been a prominent political point in Canadian politics, including the Conservative party stating they would scrap the tax if elected, versus the NDP government who previously supported the tax but, since September 2024, have now agreed with axing the consumer carbon tax regulations, with a focus on charging big polluters.

Do you earn a modest income? Make sure you’re getting all the benefit and credit payments you’re entitled to! Join us for a free webinar on this, free tax clinics, and more: ow.ly/SLqy50UGfcw #CdnTax #WebinarCRA

What other types of taxes do you need a breakdown on?

Stay Updated

Get the latest news and stories delivered to your inbox.